It’s time to take a birds eyes view of the cleantech sectors.

In 2014 there has been some amazing growth in the cleantech sector. Which cleantech industries have been getting all the attention?

Although Eco Founder is not strictly a policy driven blog, I do like to write about things that impact cleantech entrepreneurs. Market trends are one of those things. This is because having an understanding the basic economics of market supply and demand will give you insights on which clean innovations will succeed in the marketplace.

Which markets are growing and which are slowing?

This is the real test to see if there more than a great technology and whether a real potential business opportunity exists. The demand for the clean technologies is something we would predict to rise over the future as long as we are seeking to address the ever imposing environmental constraints. That is exactly what is happening. Policy and consumer purchasing behaviour is changing largely due to a growing awareness of the environmental implications of modern day resource use. With all these changes there are certain markets that are growing exceptionally quickly and other markets that are disappearing completely.

Residential Solar

The Current Status

The cost of solar PV has been reduced from $7.20 in 2007 to $2.50 in 2013 and this reduction in price has caused double double digit growth in the solar PV market over the last decade from $2.5 Billion in 2000 to $91.3 Billion in 2013. In 2013, solar had a record deployment with 36.5 GW installed globally [1].

In the U.S. 4.2 GW of new solar PV was installed in 2013, deploying more than Germany (an estimated 3.3 GW) for the first time in more than a decade. China wins the deployment battle with 12 GW of solar in 2013, according to Bloomberg New Energy Finance [2]. This is roughly as much as total cumulative solar PV installations in the U.S., and nearly triple the 4.5 GW deployed in China the year before. Before 2013, no nation had ever added more than 8 GW in a single year. Even in Japan there has been impressive deployment, as they continue to aggressively push renewables. Japan is aiming to replace most of its nuclear power, so they installed a record amount of new solar PV capacity in 2013, approximately 7 GW.

The Future of Solar

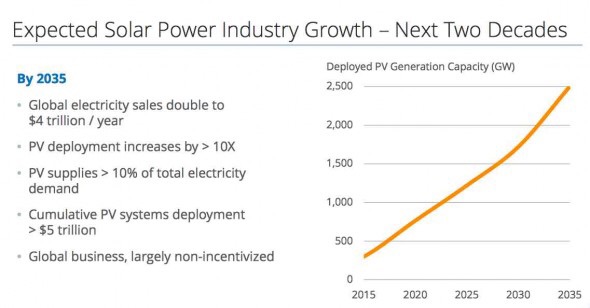

The CEO of Sun Power, one of the largest solar PV manufactures in the world, estimates that the total solar market (PV, CSP. etc) could grow to be a $4 Trillion dollar industry in 20 years [2]. This estimate may seem over enthusiastic, but this does indicate that the solar industry is on a trajectory for rapid growth.

Photo Credit: SunPower 2014

One of the key drivers of this growth is the installed cost of solar which expected to fall around seven percent annually. The Clean Edge research group projects that by 2021, global cumulative installed solar PV capacity will reach 715.8 GW, surpassing wind power’s projected 697.3 GW in that year. By around 2023, Clean Edge also expects the total solar PV market is expected to grow to $158.4 Billion [1]. As the industry continues to grow for distributors and installers we are also beginning to see more and more innovative companies starting up around the fringes. Companies, such as pick my solar, are starting to create a network of companies within the sector beyond the traditional distributors and installers. For the solar industry in general I would expect to see more and more possibilities for innovation whether it be technological or business model innovations.

Residential Energy Efficiency

The Current Status

Policy has been a large driver in the energy efficiency sector with twenty-six states that have adopted and adequately funded an energy efficiency resource standard (EERS). The EERS sets long-term energy savings targets and drives investments in utility-sector energy efficiency programs. Annual budgets for these utility-sector programs are projected to continue to rise to meet national energy efficiency targets and these programs rose to $5.98 billion in 2012 [5].

Smart Meter Deployment

Currently smart meters have been deployed across 43% of US homes. Utilities are fast approaching the point where smart meters are the norm, not the exception, with nearly 50 million networked, two-way communicating smart meters up and running across the country as of July 2014, [3]. Utilities are highly incentivized to continue smart meter rollouts with another 25 million installations already funded and 80% saturation (132 million devices) expected by 2020. The successful deployment of smart grid technologies could yield savings to society of $130 billion annually by the end of this decade, [4].

Future of Energy Efficiency

As policy changes to help implement new energy efficient technologies we should expect to see rapid growth in startup activity as new entrepreneurial opportunities arise. The connected home and home automation technologies are beginning to combine energy efficiency to their product lines and we should expect this trend to continue into the future. The large deployment of smart meters means that, like solar, there will be opportunities with in the industry outside of the typical manufacturing, distribution and retailing of these products. There will be room for both technological and business model innovation.

Electric Vehicles (EV’s)

Current Status

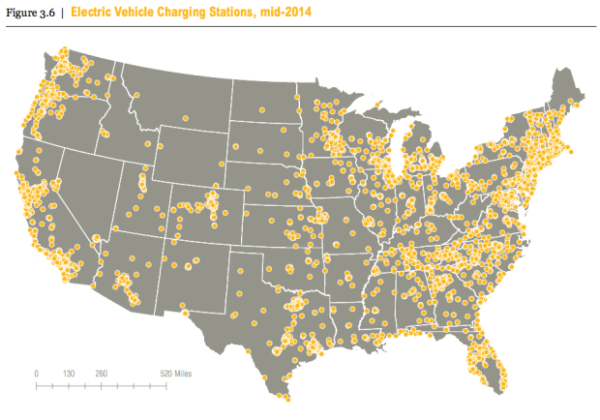

Next generation vehicle sales, of technologies such as electric and plugin hybrid vehicles, have been growing drastically in recent years. The graph below shows the growth of Electric Vehicle charging stations across the US.

Photo Credit: World Resources institute, 2014

Hybrid vehicles accounted for over 6 percent of total passenger car sales in 2013 and Plugin Electric and Hybrid Plugin electric vehicles accounted for about 1.2 percent of total passenger car sales—almost double the number sold in 2012. It’s worth noting here, that although these sales only account for a modest percentage of total vehicle sales, the uptake of plug-in vehicles has been far faster than the initial uptake of hybrid vehicles in the United States [6]. There has been several trends leading to this growth. One key driver has been that battery prices have fallen by more than 40 percent since 2010 and this is expected to continue to drop in the future.

The Future of EV

For the Electric Vehicle market to continue to grow at the rate that it has experienced in recent years, lowering cost of batteries will be needed. With Tesla Motors planning to build facilities by 2017 that will produce batteries 30 percent cheaper than today’s batteries we can expect these batteries to not only continue to lower in price but also for the growth of the EV market to continue. [6] The World Resource Institute also details that “In October 2013, eight states announced an initiative to support implementation of their zero-emissions vehicle mandates. This initiative calls for the states to coordinate actions to develop the necessary infrastructure and incentives needed to meet their mandates to have 15 percent of new cars sold within their borders be zero-emission vehicles by 2025. The multistate effort includes California, Connecticut, Maryland, Massachusetts, New York, Oregon, Rhode Island, and Vermont, which represent 23 percent of the U.S car market. This effort is expected to put at least 3.3 million of these vehicles on the road by 2025.” [6]. Reaching almost a quarter of U.S. car market by 2025 we can expect as the industry grows the demand of all things EV to increase, with a wave of innovative startups seeking to create many new jobs.

With such potential for growth won’t everyone succeed in these markets?

Determining the success of an product is not as simple as entering a huge market and fighting for a 1% share of it. It’s likely that the competition will be so strong in large market so you will probably struggle to find a competitive advantage. I mean why would customers choose you and your product over the larger more well known companies? They can probably beat you on price due to their scale, and potential customers are more inclined to choose recognised brands over yours. In addition, companies that gain market leadership look to create monopolies over their market and this means that to compete in these markets you’re still going to need a strong competitive advantage. You can’t copy the big boys and expect to win. This means that cleantech founders wishing to enter these markets will have to look to innovation through both technology and through business model innovation. The real winners will be those who understand these market realities and plan to create a sustainable competitive advantage that will stand the test of time.

“If you don’t have a competitive advantage, don’t compete.” - Jack Welch

In Peter Theil’s (Co-founder of Paypal) book “Zero to One” he talks about how new technologies must have offer customers what they perceive to be 10x more value than the other available options. This should be the competitive strategy that cleantech founders should aim for. Don’t worry, as even the most successful companies today didn’t create this 10x competitive advantage overnight. It took many years to accumulate and it’s not purely in the form of technological benefits. There are many opportunities to innovate through new business models for existing industries, innovation through marketing, and even customer service. It is a aggregate of these innovations that customers experience when they purchase your products or services.

A customers buying experience is from the point when they become aware of your offering and includes everything even down to the packaging. Brands such as Apple understand this and have been able to sustain impressive market share against strong competition. The point is that founders should prepare their entry into these markets with a game plan to fend off competition. With such quickly growing markets it is likely these markets will become extremely competitive in the next 10-15 years. So, even though these markets are growth at incredible rates, founders should still enter them with a clear value proposition and a well crafted plan to gain market leadership.

How are you going to enter these markets?

Become an ECO founder

Start the 30 day ECO founder Challenge (it’s free!) to learn how to startup your own clean technology business.

No spam, ever. You can unsubscribe at anytime.

[1] Pernick, R. (2014). Clean Energy Trends 2014. Clean Edge. Retrieved December 5, 2014.

[2] Bloomberg New Energy Finance (2014). World’s Most-Polluting Country Leads in Clean-Energy Investment. Retrieved December 5, 2014.

[3] Southern California Edison (2014). BUILDING BLOCK OF THE EVOLVING POWER GRID: UTILITY-SCALE SMART METER DEPLOYMENTS.

[4] McKinsey & Company (2010). Can the smart grid live up to its expectations?. Retrieved December 6, 2014.

[5] 2013 State Energy Efficiency Scorecard. (2013). American Council for an Energy Efficient Economy. Retrieved December 5, 2014.

[6] BIANCO, N., MEEK, K., GASPER, R., OBEITER, M., FORBES, S., & ADEN, N. (2014, October 1). SEEING IS BELIEVING: CREATING A NEW CLIMATE ECONOMY IN THE UNITED STATES. Retrieved December 5, 2014.

Photo Credit: jurvetson cc